As in most countries, in France, when you enter the Social Security system, you are allocated your own unique Social Security (SS) number. This magic number unlocks many advantages, takes several forms, and is paid for by various means. In this article, we’ll take a look at all of these points with the aim of demystifying the facts surrounding your French numéro de sécurité sociale!

How do you apply for a French SS number?

French people are allocated their Social Security numbers (or Numéro d’Inscription au Répertoire, NIR or National Repertory Registration) at birth, but foreign nationals moving to France will need to make an application to be allocated their number. The usual way to do this is to apply to enter the French healthcare system, PUMa, in order to eventually receive a Carte Vitale (social security card), which carries your SS number on it.

You apply for PUMa healthcare coverage through the head office of your department’s CPAM (Caisse Primaire d’Assurance Maladie – the offices which deal with healthcare paperwork). You have the right to apply once you have been a legal resident in France for three months continuously with the intention of staying here.

How long does it take to be allocated a French SS number?

Hmmm, well, if you have any experience of the administration system in France, I bet you are pre-empting my answer to this! Our quickest delivery of a permanent SS number was 4 weeks, but we’ve also fought for almost a year for a couple! As with many admin processes, the application process is paperwork-heavy, with hardly any wiggle room. Documents are frequently returned and/or re-requested, accompanied with a lexical slap on the wrist, for the seemingly smallest of reasons, if any are given at all! Files are also lost regularly, so it pays to keep copies of absolutely everything and to never send originals in the post.

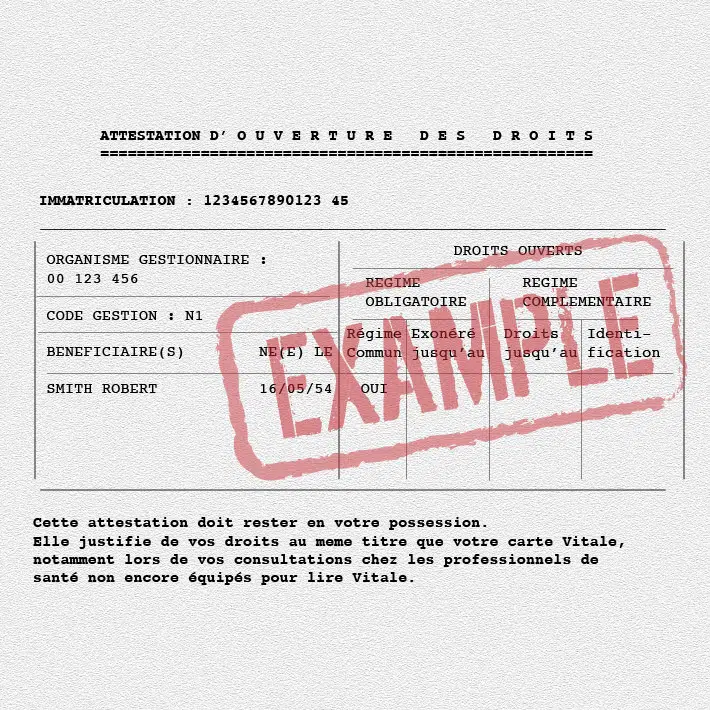

However, if you can get through the initial application process, you should receive your temporary SS number (see the numbering system below) within (and I’m talking non-Covid and non-Brexit times here) about 4-10 weeks (habitually depending on current demand in the CPAM head office of the department you are applying in). At this point, you will be sent an Attestation de Droits de Santé, showing your details, plus your temporary SS number. Once you have this, you can downgrade your private health insurance plan (PHI – it is a legal obligation for all residents to have health cover, so this is needed pre-application) to a top-up level.

What about if I am working in France? How do I apply then?

You will be surprised and delighted to hear that this system has just got a whole lot easier! Although they seem to have forgotten to let anyone know… (We love it when we find things out through sheer determination to find a solution to a problem!) Previously, if you started a business in France, you would complete a lot of paperwork (quelle surprise !) and send it off to various organizations. Eventually some of that paperwork would somehow find itself with the old RSI, newly-named SSI, for your temporary SS number allocation.

(Note that business temporary SS numbers allocated under the old system were not even ‘real’ temporary numbers – they had seemingly random numbers at the beginning, followed by a heck of a lot of zeros! These numbers have no gravitas in the land of French Social Security until you apply to CPAM to then get ‘real’ temporary SS numbers, then your permanent number.)

Then there would be another wait, once you’d returned a few more docs, bien sûr, to be allocated your permanent SS number. Now, however, as soon as you have received confirmation that your business is registered, you should simply apply to CPAM like everyone else. There are a few different boxes to tick, and documents to add, but there is certainly more control over timings than previously, and the fact that all PUMa applications are handled by one body definitely makes the process smoother.

Who allocates the SS numbers?

A central, government-run, organization called INSEE (Institut National de la Statistique et des Études Économiques – National Institute of Statistics and Economic Studies) allocates the SS numbers.

What do the numbers mean?

SS numbers are made up of 13 digits plus a 2 digit ‘key’. In fact, there is a clever number allocation system for the creation of each SS number. The allocation of the first 7 digits of the long number makes this part easier to remember for most folk.

1st digit = 1 = male permanent SS number (= 7 temporary number)

1st digit = 2 = female permanent SS number (= 8 temporary number)

2nd & 3rd digits = the year of your birth (last two numbers thereof)

4th & 5th digits = the month of your birth

6th & 7th digits = the French department number the person was born in. For those born outside of France, this is 99

I bet if you have one, you’ve got your Carte Vitale out now and are checking it?! Clever, hey?

I won’t bore you with how they calculate the rest of the numbers; suffice to say, the number-crunchers have a system which means that each person is allocated a unique number.

What benefits does being in the French Social Security system give you?

- Family allowances

- Health, maternity, paternity, disability and death

- Retirement pension

- Unemployment benefits

- Occupational accidents and illnesses

How do you pay your Social Security contributions?

- If you are salaried, your contributions are taken directly from your pay

- If you are self-employed, these are paid when you make your monthly or quarterly declarations

- If you are inactive (not working), you will be invoiced for what is colloquially known as the PUMa tax, but is actually called the CSM (Cotisation Subsidiaire Maladie) tax. The way your personal figure is calculated is very complicated! But the result is almost always more than affordable. Each person has an allowance of 20,000€ before the tax is applied, plus only capital income (eg salaries, rental income) is counted, but income from pensions, etc. is discounted. You’ll pay about 6.5% on the resulting figure. There is also a ceiling of approximately 20,000€.

So there are a few pointers as to how the French Social Security system works! For assistance applying for a Carte Vitale, or for information about Healthcare in France, check out our Lifeline Support Service and Healthcare Ebook Bundle in the website Shop.

Of course, I could tell you a lot more here, but I’m sure your sleep aid of choice would rather be listening to whale music, or a nice glass of local rosé!

Nicole is a bilingual Brit from Cambridge who has been living in the Languedoc since 2002 and is one of the first Renestance's Consultants. She knows how to get things done and can find the key contacts, having worked in real estate, managed two businesses of her own, and started a large social group for English-speakers in the area.

All articles by: Nicole Hammond

brian hennessey

on 2024-11-04 at 21:38it’s not THAT clever bec your ss# is 13 digits long but the CV has 15. go. figure.